A roundup of news and multimedia from the Unfamiliar Terrain team:

San Francisco

S.F. supervisors back tenant, small-business protections in Lurie’s ‘Family Zoning’ plan (SF Chronicle): Mayor Lurie’s family zoning plan would raise height limits and add density on the north and west sides of the city, but some elected officials, residents, neighborhood groups, and organized labor are pushing back, and various amendments are being considered.

New report says SF Family Zoning Plan will fall short of state housing mandates (SF Standard): The city economist’s analysis finds rezoning could yield far less housing than the Planning Department projects. Report available here.

Demand for SF offices is highest in the country (SF Standard): Demand for office space in San Francisco has doubled year over year, with particularly strong growth in the tech sector.

S.F.’s North Beach divided over proposal that could shake up retail in the historic neighborhood (SF Chronicle): Some businesses and residents are worried that a change in zoning could mean that neighborhood staples could lose protections that have helped them survive, while supporters believe that the legislation will make it easier to fill vacant spaces.

Bay Area

Plan Bay Area 2050+, draft plan and Draft EIR out for comment (MTC and ABAG): After more than two years of public discussion, technical analysis and refinement, the Metropolitan Transportation Commission (MTC) and the Association of Bay Area Governments (ABAG) have released Draft Plan Bay Area 2050+ for review and comment.

Newsom authorizes Bay Area transit tax measure for 2026 ballot (CBS News): Gov. Newsom signed legislation authorizing a ballot measure for Bay Area voters to decide whether to increase sales taxes to fund transit.

BART made it easier to pay. Here’s how many riders are tapping the new system (SF Standard): Ridership is up 25% since January, and agency officials say the recent rollout of contactless payment may be the reason.

Homes in this Bay Area region are selling at a slower pace — and for less. What’s behind the cooldown? (SF Chronicle): Return-to-office mandates may explain shifting demand from further out suburbs to San Francisco and the South Bay.

Marin County town officials renew fight over proposed housing, even as a recall election looms (SF Chronicle): Fairfax’s mayor and vice mayor are facing a recall election that’s tied to housing development in the Marin County town.

California and Beyond

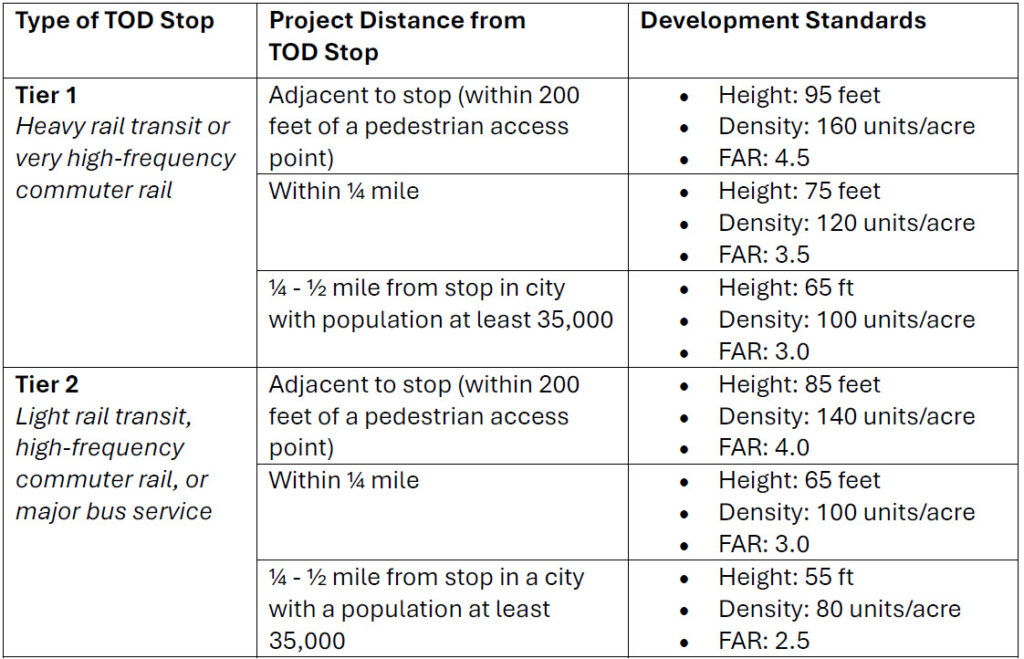

Newsom signs major housing bill allowing for dense construction near transit (SF Standard): Senate Bill 79 upzones heights near high-quality transit in eight counties, including four Bay Area counties (San Francisco, Alameda, San Mateo, and Santa Clara). We’ve written about the bill here.

Why California’s historic housing law gave activists a new reason to battle the bus (CalMatters): Opponents to dense housing developments in Los Angeles County are organizing against planned bus routes in response to Senate Bill 79.

Condos Provide Affordable Homeownership, So Why Doesn’t California Build More of Them? (SPUR): High insurance costs for condo builders, resulting from construction defect liability laws, may disincentivize condo development.

The Twin Cities of Grass Valley and Nevada City, Calif. (NY Times): Exploring two towns in the Sierra foothills and a recent influx of new residents.

This California town is battling the state’s deepest housing conundrum (SF Chronicle): Nevada County grapples with the need for more housing in wildfire country.